by Carl Delfeld, Investment U Senior Analyst

Tuesday, February 28, 2012: Issue #1718

When visiting emerging and frontier countries, I?m always struck by the dominance of state-owned companies and powerful tycoons. The state and a handful of powerful families in each country seem to control everything from cellphones to breakfast cereals.

You need look no further than the richest tycoon in the world, Carlos Slim. His family-controlled businesses account for an astounding 34% of the entire Mexican stock exchange!

It seems a bit feudalistic to me, but this is a reality we must accept. Here are a few more examples from William Gamble?s new book, Investing in Emerging Markets: The Rules of the Game.

About 35% of Russia?s market is dominated by three enormous state-owned companies: Gazprom (OTC: OGZPY.PK), the world?s largest gas producer, Sberbank (OTC: SBRCY.PK), the largest Russian bank, and Rosneft (OTC: RNFTF.PK), the company that ?inherited? the assets of Yukos.

For China, its top five companies make up a bit less than 30% of the market: PetroChina (NYSE: PTR), ICBC (OTC: IDCBY.PK), Bank of China, China Construction Bank (OTC: CICHY.PK) and the Agricultural Bank of China (ACGBY.PK).

The 179 listed companies in the Gulf are at least partially owned by 51 government entities. Governments controlled almost 30% of the region?s total market capitalization.

Finally, Brazil has the mining giant Vale (NYSE: VALE) dominating it stock market, but the combination of Vale and Petrobras (NYSE: PBR) (with sizable state ownership) make up 30% of the Bovespa alone. If you add the shares of Vale and Petrobras to the other three in the top five, which includes two banks, Itau Unibanco (NYSE: ITUB) and Bradesco (NYSE: BBD), and brewer, Ambev (NYSE: ABV), you end up with the most-concentrated stock market in the world, at 48%.

You can see that state-owned companies are overwhelmingly concentrated in either finance, or commodities such as oil.

Now let?s turn to big emerging market companies controlled by wealthy and well-connected families.

What strikes me here is that these tycoons inevitably target the simplest and most predictable of industries. The attraction is the dependable cash flows that come with investing in predictable industries like cement, banking, insurance, cellphones, retail and food.

Now, you may just want to invest in government-backed and tycoon-sponsored companies. After all, if you can?t beat them, join them, right?

Well, I think you can do even better by blending in some emerging market small caps if you have the stomach for a bit more volatility.

In the United States, small caps have proven to outperform large caps, and the same goes for emerging markets. During the rebound after the financial crisis from early 2009 to late 2010, the average annualized return of eight small-cap emerging market funds rocketed 82% ? more than 20% higher than large-cap emerging markets.

While there are 20 small-cap emerging market funds on the market, one that just reopened to investors has been a favorite.

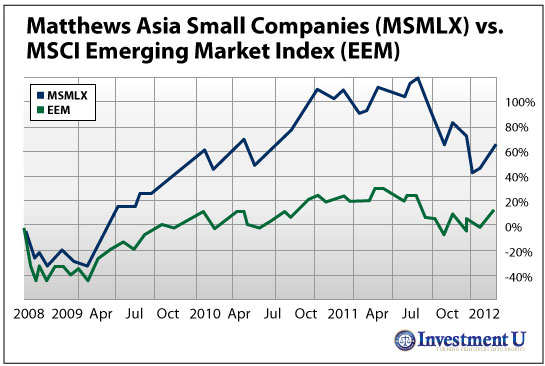

Matthews Asia Small Companies (MSMLX) has outperformed since its launch in 2008 with an annual average return of 18.2%. You can see from the chart below that it has outperformed the big company standard bearer MSCI Emerging Market Index (NYSE: EEM) by a huge margin.

The companies in this fund are very different than EEM?s big financial and energy companies with 22% in consumer stocks and 17% in information technology. About 44% of the stocks in the fund have a market value between $1 billion and $5 billion with the balance under $1 billion.

Cover all the bases by blending in some emerging market small companies alongside the familiar giants.

Good Investing,

Carl Delfeld

Any investment contains risk. Please see our disclaimerRelated Investment U Articles: **By submitting your comment you agree to adhere to our Comment Policy and Privacy Policy.

Source: http://www.investmentu.com/2012/February/small-cap-emerging-market-growth.html

how to get ios 5 how to get ios 5 eric holder eric holder avengers trailer the avengers trailer the avengers trailer

কোন মন্তব্য নেই:

একটি মন্তব্য পোস্ট করুন